Blog

Appraisal Waiver

Many buyers and agents ask if it’s possible to purchase without an appraisal. Or, if they can waive an appraisal contingency in their contract without increasing their risk.

The appraisal waiver / value acceptance can help with that – and here’s how it works.

Fannie Mae and Freddie Mac (government entities) require we upload appraisal reports to their databases so they may be automatically underwritten.

This software, called collateral underwriter by Fannie Mae (CU) and Automated Collateral Evaluation by Freddie Mac (ACE) scores reports 1-5 based on risk of overvaluation. 1 is lowest risk, 5 is highest risk. CU/ACE rely on the data pulled from all other appraisal reports to determine this score. If an appraiser revises an appraisal report, it gets re-uploaded and re-scored.

CU has tens of millions of appraisals at this point.

Thanks to the data from these appraisals, it’s possible for CU or ACE to waive the requirement to complete an appraisal at all. This is called an appraisal waiver.

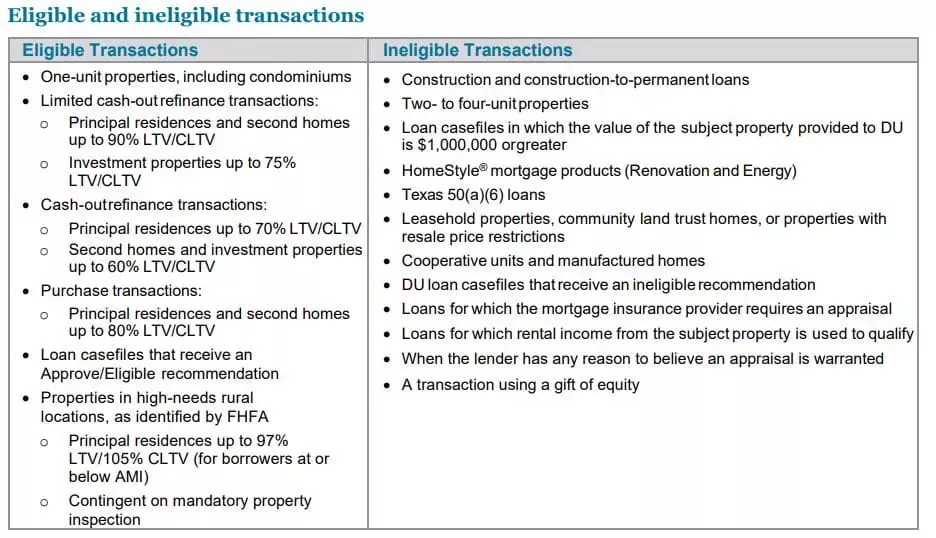

We can only run this software with a client who has a current pre-qualification. This software is something we can run prior to a buyer making an offer or after making an offer. For an appraisal waiver to be possible, the following need to be true:

- Purchase price under $1 Million

- 20% down or more

- Single family, rowhouse/townhouse, or condo property. Co-ops and multi-unit are ineligible

When we run this software, it doesn’t tell us at what price an appraisal waiver is offered. We have to run the software and wait. If we lower the price or increase the down payment percentage, this improves the chance of an appraisal waiver.

An appraisal waiver is only possible if CU/ACE have an existing appraisal of the property in their database, AND that existing appraisal did not get flagged as high risk of overvaluation, AND the data from other recent appraisals of similar properties validate the price being input into the system.

An appraisal waiver software has more flexibility if a buyer is willing to put more than 20% down.

Let’s imagine a buyer wishes to make an offer on a property at $600,000 but the appraisal waiver is only offered up to $570,000 with 20% down. If a buyer is willing to finance 80% of $570,000, which is $456,000, it’s possible to still utilize an appraisal waiver even at a purchase price of $600,000. We’re technically financing a loan at 80% of the value, even though the loan is 76% of the purchase price.

https://singlefamily.fanniemae.com/media/5916/display

https://singlefamily.fanniemae.com/media/9456/display

https://sf.freddiemac.com/faqs/automated-collateral-evaluation-ace-faq

Pre-Qualify Now: https://ajaffe.firsthome.com/startapp

ajaffe@firsthome.com 240 – 479 – 7658