Blog

Estimating DC Property Taxes

Here is a tutorial to how I estimate property taxes. DC’s property tax rate for Class 1 residential property is .85%/year of the assessed value. So if a property is assessed at $100,000, the annual taxes would therefore be $850 a year. However DC homeowners might have reductions to their tax bill for a number of reasons, including a reduction for being a senior citizen (and meeting other requirements), a reduction for living in the property as a primary residence, or a reduction based on their income.

In order to estimate property taxes, you must first look up the assessment. Here’s how to do that.

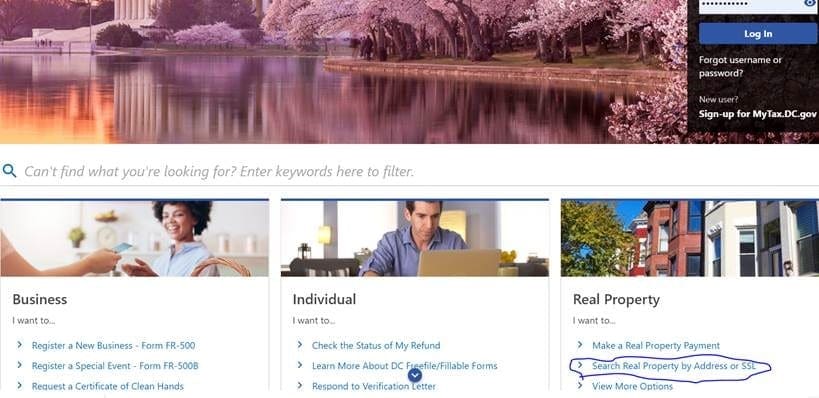

- Visit this link https://mytax.dc.gov/_/#1

- Scroll down and click under the real property section, search real property by address or SSL (square suffix lot)

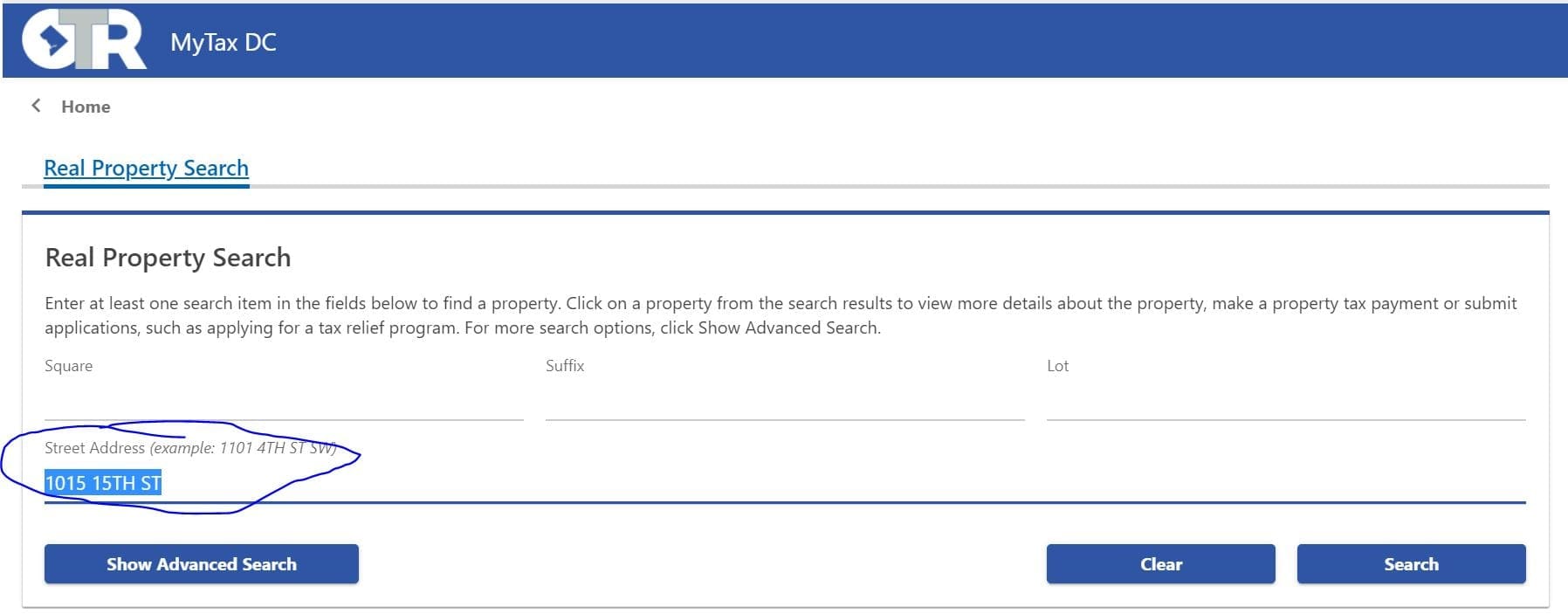

3. Type in address as normal and click the search button.

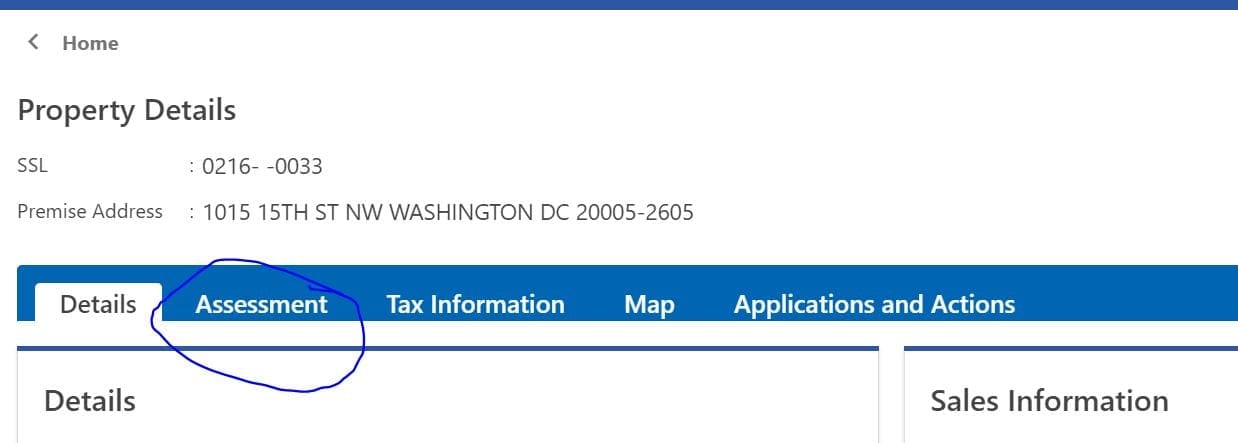

4. Then click on the link on the left side of the correct property address (the link is the tax id – also known as the square and lot) to open the tax page for the specific property.

5. Once you’ve opened the tax page for the specific property, click on assessment tab

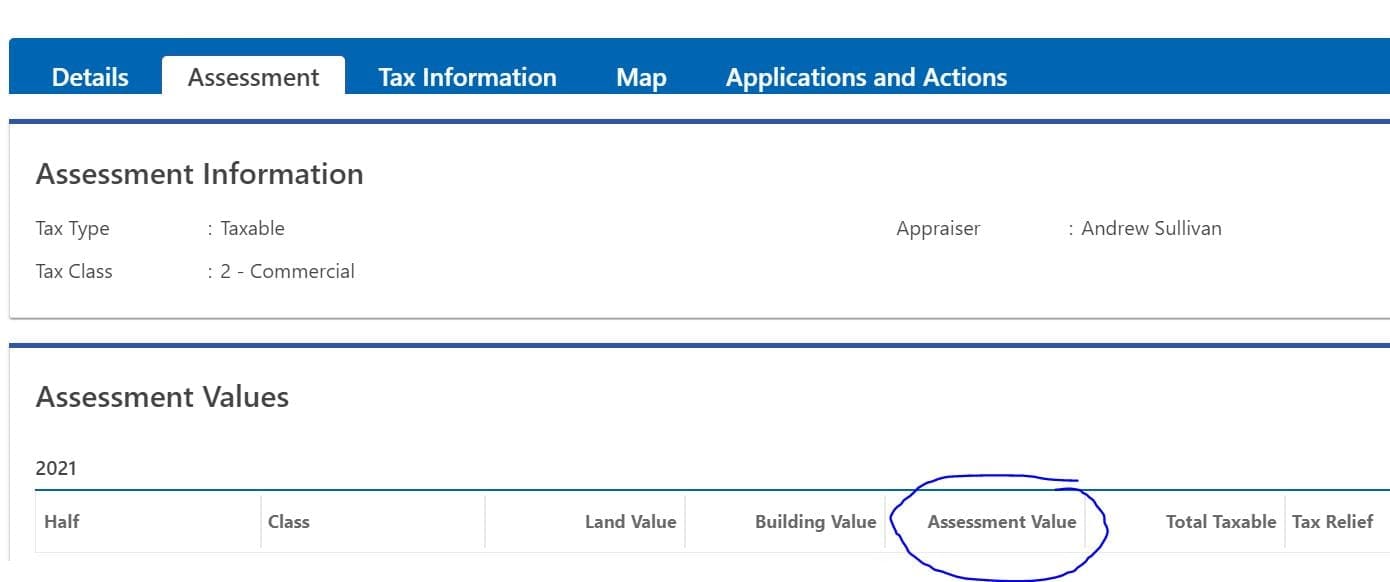

To calculate taxes, if it’s a purchase use .85% per year of the assessment value…not the total taxable.

The assessment value is the current assessed value of the property and does not factor in any deductions the current owner is receiving to the assessment. The current owner’s total taxable might be reduced by the homestead deduction. The homestead deduction limits how much the taxable assessment can rise, and also provides a reduction of the taxable assessment for owner occupants.

With a new purchase of the property the purchaser can expect the DC office of tax and revenue to reset to the current assessed value rather than tax on the taxable assessment enjoyed by the seller. This will not happen immediately but is a likely occurence after purchasing so that the district can maximize tax revenue. But a purchaser can also apply for a homestead deduction after purchasing, and they should absolutely do so with this link: https://mytax.dc.gov/_/#4

If we’re estiamating property taxes for a current owner and they live in the property, if the total taxable is less than the assessed value, we will estimate taxes off the total taxable number instead. The total taxable will take into account homestead deduction, and the reductions the current owner is entitled to. If a homeowner is receiving the senior tax reduction, that’ll cut in half the property tax bill that would otherwise be paid. Or if a homeowner is tax exempt, that’ll abate property taxes for up to 5 years. https://alexjaffe.com/homestead-deductions and https://alexjaffe.com/dc-tax-abatement

If however we’re doing a purchase and the property is a newly renovated flip, I typically estimate the taxes off of the purchase price. This is something I might also do if I see a property where the assessed value is significantly less than the purchase price. This is because I might expect DC to very quickly re-assess the property at the sales price and issue a supplemental tax bill to back-tax to the purchaser’s purchase date.

The reason why a website’s payment calculator might not be a great estimate of taxes for a home you are considering buying, is that they are going off old data. Websites that homeowners typically search for real estate with, often report the tax amount that the seller is currently paying in property taxes. Also oftentimes, the tax bill being used is from last year’s bill, rather than this year’s bill. DC’s fiscal year runs October-September. The 2021 fiscal year began October 2020-September 2021. Meaning that beginning in Summer of 2020, we need to begin estimating taxes off the 2021 tax assessment, not 2020, to be accurate in our estimations. If a seller of a property is enjoying a reduced bill from a senior citizen deduction or a homestead deduction that will not carry over to the buyer, the reported tax bill on a real estate search website will be inaccurate. The methodology reported in this blog post is what I’ll use to estimate taxes for a purchaser.

Questions?

Pre-Qualify Now: https://ajaffe.firsthome.com/startapp

ajaffe@firsthome.com 240 – 479 – 7658