Blog

Federal Home Loan Bank

On 2/23/26, FHLB will be available until funds exhaust!

The Federal Home Loan Bank (FHLB) program provides a $15,000-$20,000 grant or forgivable loan to be used towards down payment and closing costs.

There are three programs:

The Workforce Housing Grant offers a $15,000 grant, to home buyers with incomes from 80-120% of area median income [repeat and first time home buyers are eligible]

Income caps in the DMV:

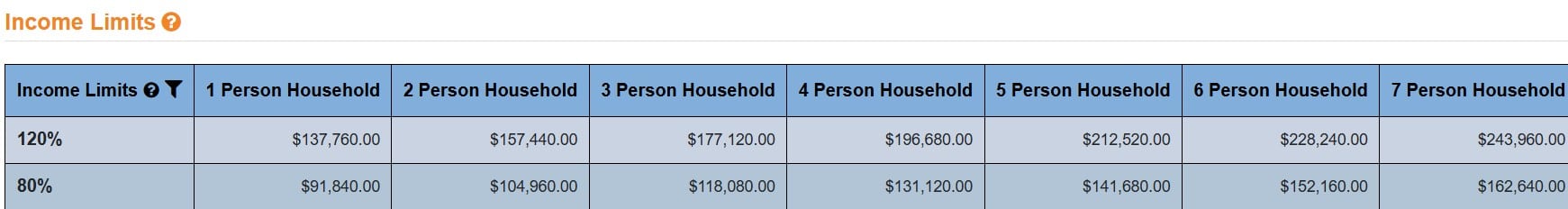

1 person household income cap is $137,760, 2 persons $157,440, 3 persons $177,100, 4 persons ~$196,680, 5 persons $212,520

OR

First time buyers are eligible for a $17,500 forgivable loan, forgiven over 5 years [maximum income is 80% of area median income]. Income limit chart for DMV is below:

OR

Community partners (veterans, or home buyers in healthcare, law enforcement, education, firefighter, or first responders, can eligible for a $20,000 forgivable loan, forgiven over 5 years [maximum income is 80% of area median income]. Buyers in these careers do not need to be first time buyers to be eligible.

Home buyers who haven’t owned real estate within 3 years are defined as first time buyers. The program is available in DC, MD, & VA. Home buyers will put down 3% on a conventional loan, and the grant may be used towards their down payment or closing costs. Repeat home buyers with income over 80% of area median income will need to put 5%+ down.

The income limit is based on family size. Eligibility is based on income from the entire household rather than just the applicants on the loan. You’ll need to declare all the people who’ll live in the home and document all income. Income chart for DMV is below:

Or, here is the link to check the income limit for other areas: https://cis.fhlbatl.com/regsponsor/incomecalculation

The minimum credit score for the program is 620, but the buyer needs to be able to be approved through automated underwriting software (and approval is more likely at higher credit scores).

Condos, townhouses and houses are eligible (co-ops are not)

A buyer needs to complete a first time buyer counseling class while under contract which has a fee of $275.

Funds will be available until exhausted and the funds can only be reserved after you have a signed purchase contract.

Want to consult and see if this program is best for you? https://www.calendly.com/alexjaffe/30min

Looking for an FHA down payment assistance program? Or other programs with higher income caps? Visit https://alexjaffe.com/dpa

Pre-Qualify Now: https://ajaffe.firsthome.com/startapp

Questions? ajaffe@firsthome.com 240 – 479 – 7658