Blog

Housing Solstice

I’m Alex Jaffe, I work for First Home Mortgage, and we finance homes here in DC, MD and VA.

I’m going to explain how financial conditions are impacting the housing market, why in 2022 so many Americans lost interest in purchasing a home which was a reversal from last year, and why we all have a lot to look forward to in 2023.

This last quarter of 2022 has seen been the housing winter solstice. It’s a turning point, and there’s bright days ahead.

Inflation

This week, two important things occurred.

On Tuesday, we received monthly data on inflation, and although inflation is quite high, the numbers were not as high as anticipated. Inflation measures the rate at which prices are increasing, and the year-over-year rate was 7.1%. The federal reserve wants it to be 2%, and so because it’s at 7.1%, the federal reserve is doing all it possibly can so that future readings are closer to the target. The federal reserve’s mandate is to pursue maximum employment in the US and maximum price stability, keeping unemployment low and inflation near its target. Unemployment is low, but inflation is well above its target and has been for a year.

The good news is, inflation has been coming down, because it’s been closer to 8 or 9% for the past six months! A reason inflation has been decreasing is thanks to the federal reserve who’s been raising the federal funds rate since March. The federal funds rate is the rate at which banks borrow overnight from each other. The federal funds rate is used as a benchmark for many other interest rates, mostly interest rates that are used for short term borrowing, like credit cards or home equity lines of credit. By raising this rate, it makes investment and purchases more expensive, which decreases demand, which subsequently decreases how high goods and services can be priced.

Rates

It is commonly (but mistakenly) believed that the federal funds rate moves mortgage rates. Mortgages are borrowed long term; the federal funds rate directly impacts short term loans, and only influences long term loans. The good news is that, primarily because inflation is going down, mortgage rates have also been going down. And therefore, the action that the federal reserve is taking to combat inflation, by raising the federal funds rate, is actually also indirectly, over time, helping mortgage rates decrease. According to mortgage news daily the average interest rate peaked this year at the end of October/early November at 7.3. The average rate has been trending down since November 10th, which was the day that last month’s consumer price index came out, and on that day, the inflation reading was also less than the market anticipated. Currently, again according to mortgage news daily, the average interest rate is 6.13. On a $500,000 loan that’s $387/mo, and so, that amount of movement is meaningful.

And so there’s been a lot of good news the last five weeks with regard to inflation, and that’s good news for interest rates.

Payment to Income Ratio

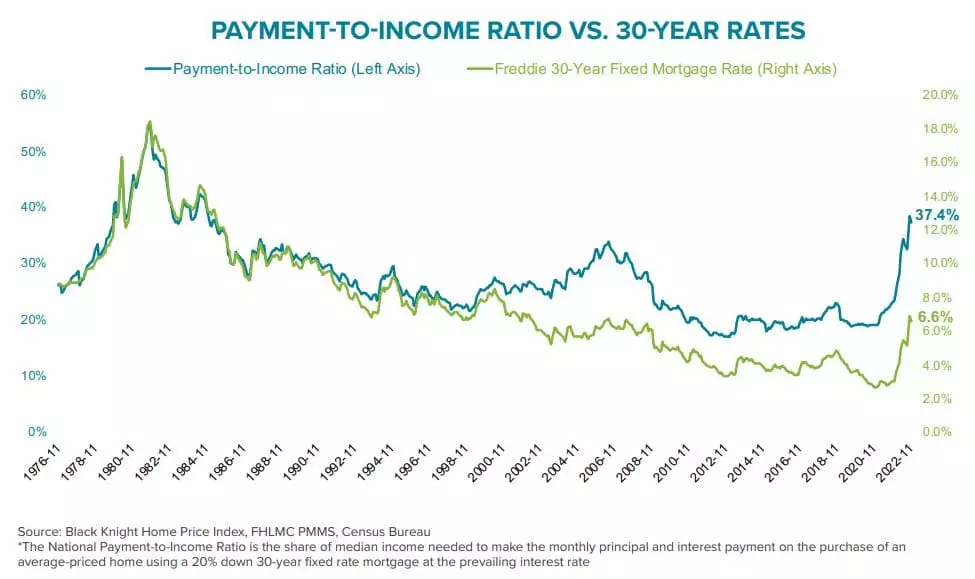

Black Knight is a company that monitors and releases data on the housing and mortgage market. They put out a monthly payment to income ratio.

For the past several months, the amount of money new home purchasers have been paying for their mortgage has been the highest since 2006. And in this past quarter, it’s been the highest since the early 80’s! And so, the payment to income ratio being as high as it is, and rising as fast and as much as it is, is reflecting that housing payments are not as affordable as they used to be.

The good news is, because interest rates have been declining since November 10th, the data on next month’s payment to income ratio will likely be better, meaning, new home payments will reflect that payments are becoming more affordable. Source

Home Purchase Sentiment Index

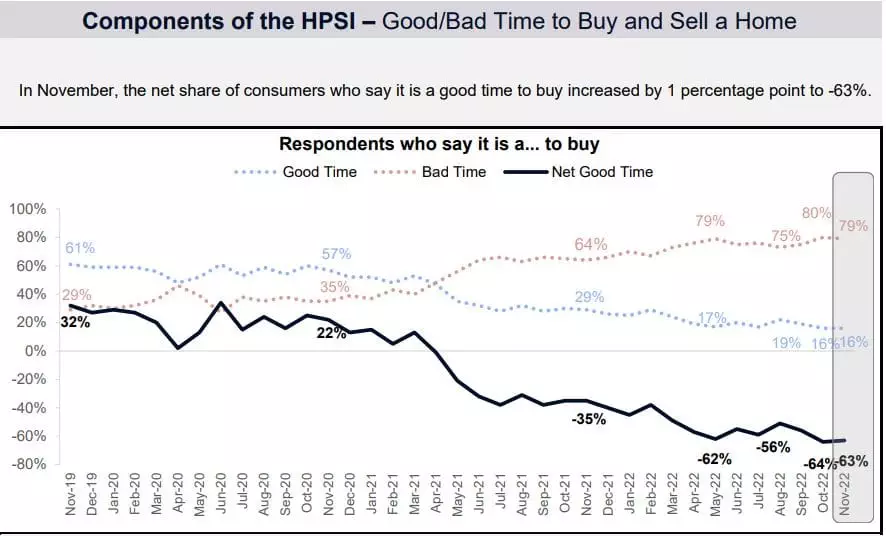

That is very encouraging news, because on December 7th Fannie Mae posted its latest home purchase sentiment index, which showed that only 16% of Americans surveyed think it’s a good time to buy a home. 79% of Americans think it’s a bad time to buy a home.

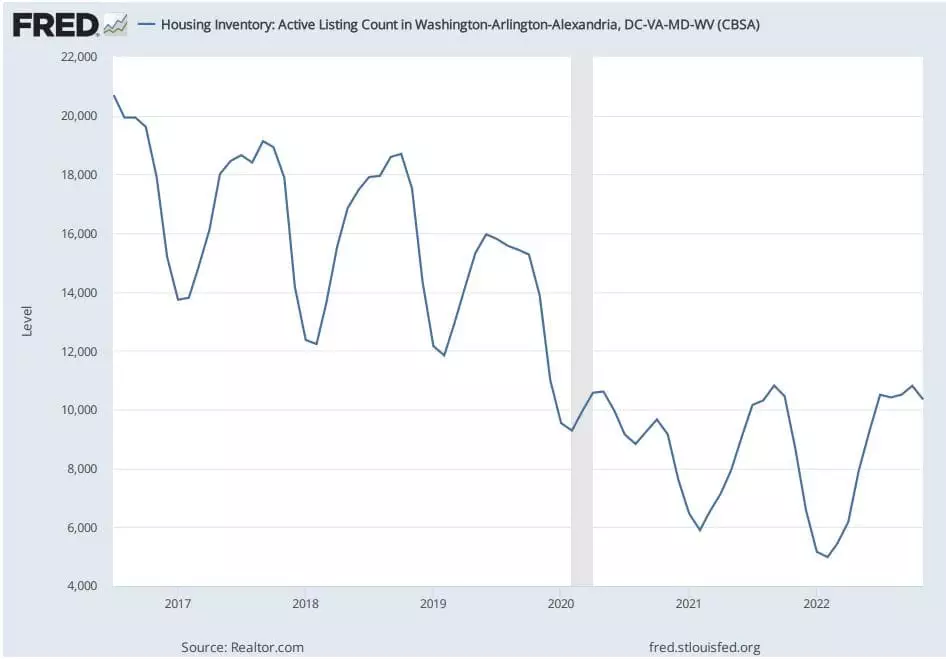

The housing market has slowed in the second half of this year. Buyers are in shock from higher payment to income numbers, and there’s also a low inventory of housing available, in part because sellers are choosing not to list. 54% of Americans surveyed think it’s a good time to sell, and 39% a bad time. As those numbers improve, as more sellers see it as a good time to sell, we likely see more inventory and more property for buyers to choose from.

I expect home purchase sentiment to improve over time, as the payment to income ratio improves. We want Americans to be (1) more satisfied with the housing payment they are taking on, (2) satisfied with their income being at a level to afford the housing payment, and (3) have a positive outlook on the stability of that income. With that, we’ll see more Americans thinking it’s a good time to buy a house, and when that happens, they buy houses.

At this moment, it’s the ides of December. Most of the world is looking to enjoy the holidays and push off home purchase related activity to the next year. Activity will pick up in 2023, both because the payment to income ratio is going to improve, and seasonally there’s more inventory as we approach Spring, and buyers will be more motivated.

It’s a pleasure to be your loan officer,

Alex

Pre-Qualify Now: https://ajaffe.firsthome.com/startapp

ajaffe@firsthome.com 240 – 479 – 7658