HPAP & EAHP

As of October 15, 2025, HPAP is funded. Per the most recent information, here’s how the program will allocate funds: https://dhcd.dc.gov/service/home-purchase-assistance-program

- Prospective homebuyers with notices of eligibility or notices to continue will work with their housing counselor and GWUL or DCHFA to pursue a notice to proceed.

- DC will prioritize assisting prospective homebuyers based on the order of their initial application and notice of eligibility date.

- Once a prospective homebuyer receives a notice to proceed, within six months they will need to go under contract and close on a home.

- If a prospective homebuyer does NOT receive a notice to proceed in this round of reservations, they will hope that they receive one in the next round which will be in approximately six months.

-

If a prospective homebuyer does not already have a notice of eligibility or notice to continue, they will hope they are issued one prior to the next round of funding and then hope they have high enough priority for the next round six months from now.FYI: This is how the program will allocate money this fiscal year. HPAP funding allocation may change next fiscal year October 2026

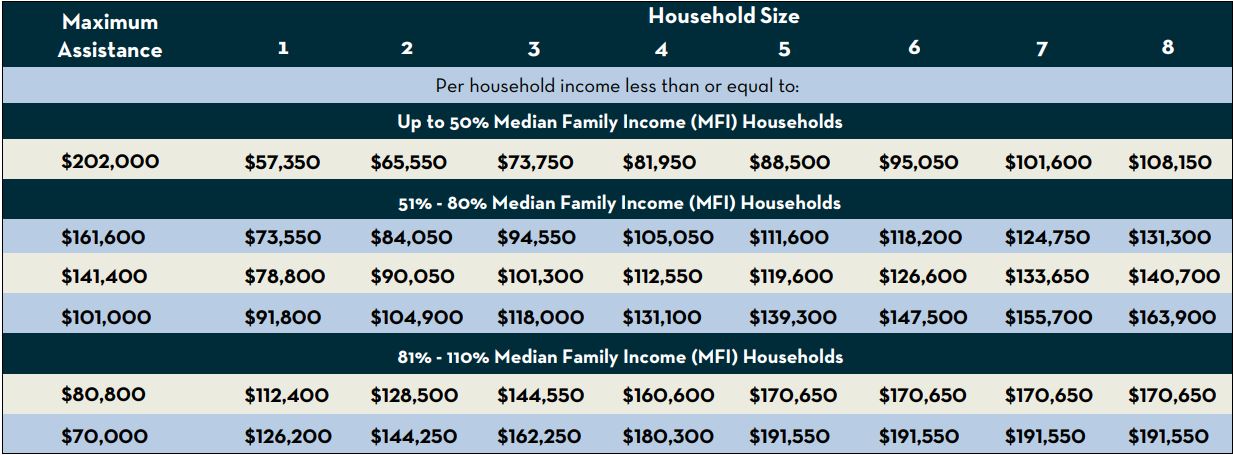

HPAP, or the Home Purchase Assistance Program, is for DC residents who are first time buyers, purchasing their home in DC and seeking assistance with down payment and closing costs. The down payment assistance loan can range from $70,000-$202,000, and the closing cost assistance is up to $4,000, for a total amount of assistance of $74,000-$206,000. HPAP assistance cannot be more than the mortgage loan the buyer is obtaining with their purchase.

Minimum cash contribution:

The minimum cash contribution for a buyer when using HPAP funds is either $500 or half of their savings above $3,000. Any gifted funds are added to that minimum contribution.

Repayment:

The HPAP loan is deferred and repaid without interest. For households with income below 80% of area median income (see chart below), there are no monthly payments on the HPAP assistance loan. For households with income above 80% of area median income, there are no payments for the first five years, and then the funds are repaid over a forty year period with no interest. The remaining sum is due in full upon moving out or selling. Therefore if you plan to move out of the property and convert it to a rental, this program may not be a good fit.

The income limits for the program vary by household size, and is found below here (last updated June 2025):

HPAP is Gap Financing

The HPAP program funds are meant to be gap financing, to make a housing payment that would otherwise not be affordable, affordable. The program guidelines require that if the proposed housing payment is less than 28% of your gross monthly income, that your HPAP loan be reduced. This is because there is a limited amount of funds allocated to HPAP annually and if a first time buyer’s proposed housing payment is less than 28% of their income, HPAP’s opinion would be that others need access to the assistance more.

For instance, if you make $50,000 a year then that’s $4,166/mo. Your housing payment must be at minimum 28% of that, $1166/mo. If the proposed loan for a property you are purchasing has a payment less than that with the HPAP assistance, the amount of HPAP assistance is reduced so that the payment is at least $1166.66.

HPAP allows you to spend maximally 45% of your income on the totality of all of your debts combined including the proposed housing payments. With an approved exception and compensating factors, they’ll possibly allow your housing payment be up to 45% of your income and all debt payments up to 50% of your income.

Property Type

It’s possible to utilize HPAP for a residential purchase in the district to buy a condo, co-op, or house/rowhouse. The only property type disallowed is 2-4 multi-unit property (and of course commercial properties as well).

Credit Score

HPAP / EAHP have a minimum 630 credit score. The mortgage loan the buyer is utilizing in combination with HPAP / EAHP may have a different/higher minimum credit score. Buyers will need to qualify for both the mortgage and HPAP / EAHP to utilize the programs.

EAHP

DC government employees may also be eligible for EAHP, or the employer assistance housing program. This provides for an additional $5,000 grant towards closing costs and a $20,000 repayable loan as well. First responders & educators are eligible for an additional $10,000 in a forgivable loan, plus an additional amount of matched grant funds, up to $15,000 instead of $5,000. Purchasers utilizing EAHP do not have to be first time buyers, but must never have owned real estate in DC previously. Purchasers utilizing EAHP can own real estate outside the district, as well. In contrast, HPAP is strictly for first-time home buyers, defined as someone who hasn’t owned any residential property anywhere within the past three years.

Most people who are eligible for EAHP combine EAHP with HPAP assistance, if they are also eligible for HPAP. The maximum sales price for getting EAHP by itself without HPAP money is $1,089,300.

Below are instructions on how to pursue a notice of eligibility for HPAP & EAHP. But in addition to that, you’ll also need a mortgage pre-qualification, and to start that you may pre-qualify through this link (click the get pre-qualified button) and after which I’ll provide additional instructions: https://firsthome.com/loan-officers/alex-jaffe/

How to pursue your notice of eligibility for HPAP & EAHP:

- The borrower must apply through a community based organization and here is the list of all organizations you can work with: https://dhcd.dc.gov/node/702332. I have the most experience with HCS (https://www.housingetc.org), ULS, and LEDC

- The borrower first attends a 2hr orientation session. They then submit their documentation to the community organization and wait for a “notice of eligibility.” Processing time for this varies, is probably at 1-2 months (currently). One of the docs required for the notice of eligibility is the credit report. If I have a credit report for a borrower, I can with permission send this to the community organization, or the organization can pull it for you.

- In addition to awaiting the notice of eligibility the borrower also needs to attend a first time buyer class. This is online or in person and is a 6-8 hour class. If you’re going through the process with HCS or LEDC, there is also homework to complete and submit, and only thereafter will you receive an 8 hour home buying class certificate.

- Once the borrower has both the notice of eligibility and the counseling certificate, they are pre-approved to use HPAP financing. Separately the borrower needs a mortgage pre-approval (from me! 🙂 ).

- The borrower once they obtain both the mortgage letter and HPAP notice of eligibility & 6-8 hour class cert, the borrower then shops for a property. When it comes to writing an offer, closings with HPAP typically take 45-60 days.

- When submitting the offer, the HPAP addendum must be signed by the parties — please request this document from me. It must be included in the contract.

- There is a required home inspection as well, with a form filled out by the inspector. If the inspector requires anything be fixed, they will need to re-inspect post-repair. We will need both the completed home inspection report and the required form signed by inspector and borrower; here is a link to the required form: http://www.dchfa.org/wp-content/uploads/2018/06/hpap-inspection-authorization-fillable.pdf

- Make sure to complete a termite/wood destroying insect inspection and send that to me as well. HPAP requires this on all properties, unless it’s a condo or co-op on the 4th floor or higher.

Here is what an applicant will provide for the HPAP pre-approval “notice of eligibility” through one of these organizations: https://dhcd.dc.gov/node/702332

Two most recent pay stubs for all applicants (ALL JOBS)

Last 60 days bank statements for ALL ACCOUNTS

Most recent 3-Years tax returns for all adults

Most recent 2-Years W-2s for all adults

Credit report

Signed Rental Verification Form (Form is provided by counselor)

Rental lease

Driver’s license or identification card for all applicants

Birth certificates for all dependents (IF APPLICABLE)

Written explanation of any credit problems (IF APPLICABLE)