Blog

CRA

We offer community reinvestment act (CRA) loan programs in DC, Maryland, Virginia which can offer improved loan terms to eligible buyers. An eligible home buyer could make just a 3%+ down payment on a conventional 30 year fixed loan and potentially not have mortgage insurance. These programs are for both repeat and first time home buyers, but an eligible buyer cannot currently own real estate. The product without mortgage insurance is called Homerun.

There are two ways to be eligible for Homerun:

1. No income cap: Buying in a low or moderate income census tract in these areas? There is no income cap:

DC: District of Columbia

MD: Montgomery County, Prince George’s County

VA: Arlington County, Fairfax County, City of Alexandria, Falls Church City, Fairfax City

https://geomap.ffiec.gov/ffiecgeomap/

2. If the census tract you are purchasing in has middle or upper income, the program does have these below income caps for a buyer to be eligible:

$108,240 or 153,960* [DC, Prince George’s County Maryland]

$132,080 [Montgomery County, MD]

$138,160 [Arlington County, Fairfax County, City of Alexandria, Falls Church City, Fairfax City]

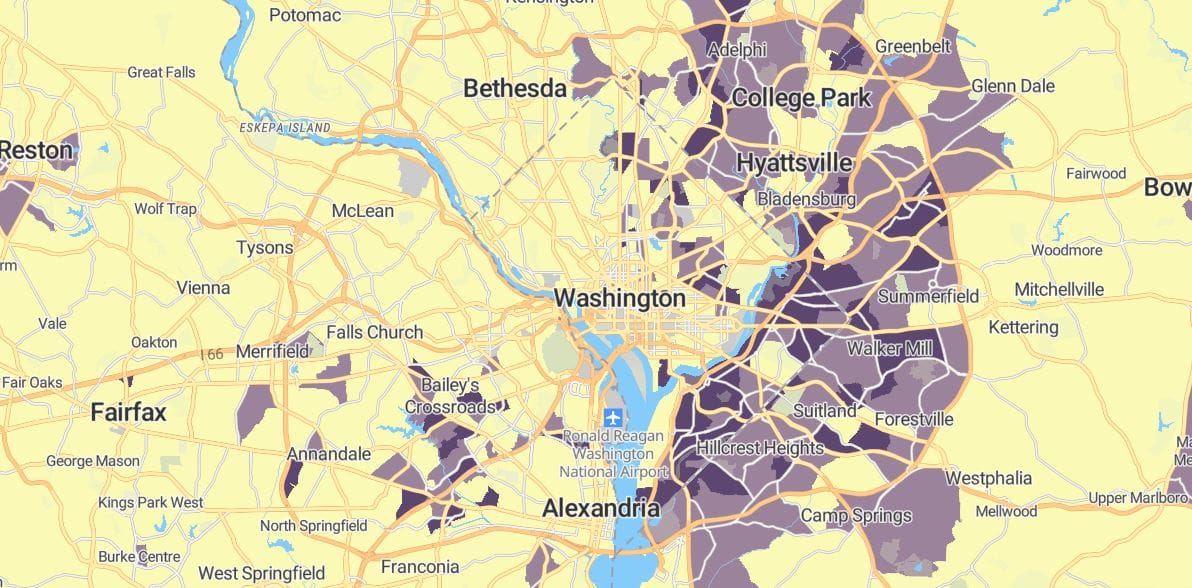

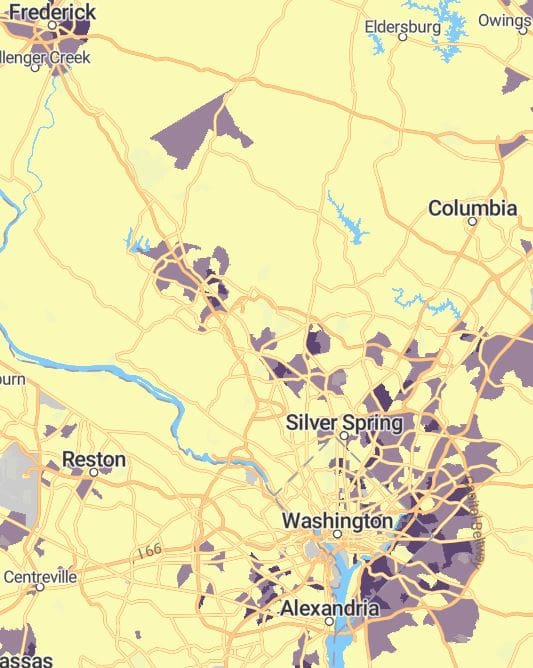

*The income cap is increased to $153,960 if you’re purchasing within a census tract with a Black/Hispanic population of 50.01%+ as of the 2024 census. [The 2024 census is still being used in 2025 as of August]. Here is a map that’s NOT official and is dated, but it will give you a sense of possible areas (in purple). If you want me to look up a particular property for program eligibility please ask me.

If you prefer to check a property yourself, the link to check is https://geomap.ffiec.gov/ffiecgeomap/. If a property doesn’t meet these requirements, the CRA program may still be available with different loan terms.

Typically the first step is setting up an initial phone call to review available loan programs and your basic finances to see if this program is a fit. The goal is to establish the best financing structure for your purchase and determine an appropriate price range for your search. You’re welcome to set an appointment with me by clicking this link: Calendly

Pre-Qualify Now: https://ajaffe.firsthome.com/startapp

ajaffe@firsthome.com 240 – 479 – 7658

The program has numerous eligibility requirements, and not all of the requirements are written below, but some are.

The most your debt to income ratio can be is 41-43% for the no mortgage insurance CRA program [Homerun], or potentially 45-50% for the loan with MI.

The minimum credit score is 640 for the loan program with no MI (660+ for a condominium). In addition to documenting having sufficient funds for down payment and closing costs, eligible buyers need to have the equivalent of two months of mortgage payments in savings in reserve (still in savings after down payment/closing costs)

A homebuyer education class certificate is required and I recommend this one https://creditsmart.freddiemac.com/paths/homebuyer-u/

Co-ops are ineligible for this program. With 5% down+ and 6 months reserves, 2-unit properties are eligible!

This program is incompatible with Community, One, Dream, Heroes, HPAP, or any bond program